Andrew L. Howell / Andrew LHowell / David R. York / David RYork

Librería 7artes

Librería 7artes

Donde los libros

Donde los libros

Librería Elías (Asturias)

Librería Elías (Asturias)

Librería Kolima (Madrid)

Librería Kolima (Madrid)

Librería Proteo (Málaga)

Librería Proteo (Málaga)

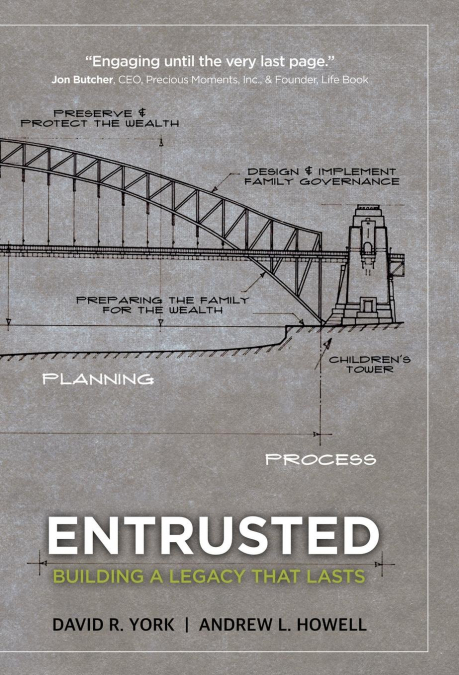

When it comes to estate planning and the effective transfer of wealth, most discussions involving the terms wealth and money use those terms interchangeably. Although the two are not the same, most estate planners today do not even broach this concept with their clients or include the less-tangible aspects of wealth as they draft an estate plan. They simply develop an estate plan that prepares the family’s financial assets to be dumped, divided, deferred, and dissipated among the members of the next generation. These estate plans typically reflect a very linear way of thinking. In other words, if transferring some amount of financial wealth is good, then transferring more financial wealth is better. Not only is this approach is myopic and simplistic, but it’s ultimately destructive because it focuses on the fire (the result) and not on the flint and kindling (the tools and resources that produce the result).Entrusted lays out the foundations of Entrusted Planning process, which aligns the principles and values of a family with their tangible assets and prepares future generations to build a true and lasting legacy. It’s a process that draws from the very origins of estate law, which placed the highest value on who was involved—on who was entrusted. Entrusted Planning goes back to preparing beneficiaries for wealth beyond just the legal concept of a trust and takes into account the relational maturation of the person or persons being entrusted as stewards of resources, not just consumers and users of it. Entrusted Planning is about transferring opportunities instead of just assets and doing so over multiple generations. By focusing on the means to an end (education, personal character, home ownership, entrepreneurship, charitable service) as opposed to the end (stocks, bonds, real estate, and businesses), Entrusted Planning has the greatest potential to do the maximum amount of multigenerational good with the least amount of collateral damage. Entrusted families have goals that are both deep and broad. They’re less interested in preparing their families to be rich and more interested in preparing them to manage, sustain, and carry on a rich legacy. Entrusted outlines seven core disciplines that can be found across a multitude of successful high-net-worth families going back hundreds of years. These are not hypothetical or idealistic disciplines. These disciplines are real and permeate through the families who have embraced these concepts. Discipline 1. Entrusted families know who they are and what they believe.Discipline 2. Entrusted families prepare the family for the wealth and not just the wealth for the family.Discipline 3. Entrusted families maximize the positive benefits of wealth and minimize the negative effects.Discipline 4. Entrusted families focus on flint and kindling and not on the fire.Discipline 5. Entrusted families are generous.Discipline 6. Entrusted families preserve and protect wealth.Discipline 7. Entrusted families design and implement dynamic governance.When a family gets to the point where they are putting their wealth behind a statement such as “We are the Smiths. This is what we believe in, this is what we value, and this is what we do to impact the world,” they will produce successive generations who can be Entrusted.